Are you a forex trader looking for a simple and effective trading strategy? Look no further than the 20 EMA Bounce Forex Trading Strategy.

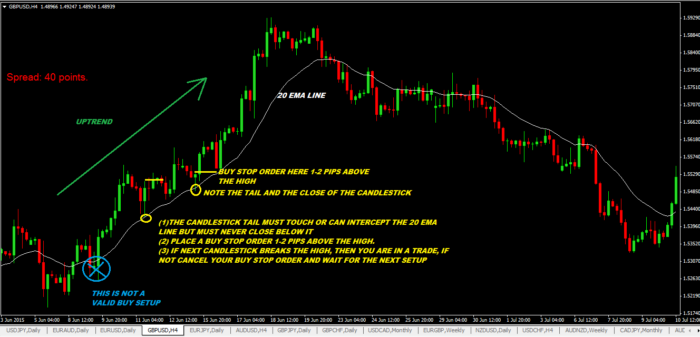

This strategy utilizes the 20 exponential moving average (EMA) as a bounce line for candlesticks. By waiting for the retest to happen and watching for the signal candlestick, you can enter trades with a higher probability of success.

Key Takeaways

- The 20 EMA Bounce Forex Trading Strategy uses the 20 exponential moving average as the only indicator.

- It is a simple trading system that can be followed by new forex traders.

- The strategy relies on price action and the retesting of the 20 EMA line.

- The best times to trade this strategy are during the London and New York Trading Sessions.

Understanding Price Action

The 20 EMA can often act as a support or resistance zone for price action. When price is in a downtrend, it will eventually rise up to test the 20 EMA line. If the downtrend is strong, the 20 EMA line will push price back down. This is called a retest and the 20 EMA is our “bounce line”.

As a trader, you are waiting for the retest to happen and watching for the signal candlestick. The signal candlestick is the first candlestick to touch the 20 EMA line after price has been moving away from it.

This method of trading, known as the average bounce trading system, allows you to enter trades based on the price action reversal candlesticks. Keep in mind that the moving average only appears to act as a roadblock to price. If you were to look left of current price action, you’d see some type of price structure acting as the real zone of support or resistance.

Identifying Market Trends

When prices are closing above or below the 20 EMA, it indicates an uptrend or downtrend in price direction. This is a key signal for traders using the EMA Bounce Forex Trading Strategy.

By identifying the market trend, traders can make more better decisions about when to enter or exit trades. To further understand market trends, incorporate additional trading strategies such as swing trading and trading naked (an understanding of price action instead of indicators).

Setting profit targets is essential for maximizing gains and minimizing losses so you don’t lose profits as price moves against you. Traders can use previous swing highs or lows as profit targets, or they can set a profit target at a multiple of their initial risk.

Signal Candlestick Importance

The importance of the signal candlestick lies in its ability to indicate the ideal entry point for traders following the 20 EMA Bounce trading approach. Here are four key reasons why the signal candlestick is crucial in this strategy:

- Price Action Confirmation Signal: The signal candlestick serves as a confirmation of the price action. It shows that the price has bounced off the 20 EMA line, validating the potential setup for a trade.

- Technical Indicators: The 20 EMA acts as a “dynamic support or resistance level”, and the signal candlestick provides a clear indication of when the price has reached this level. This helps traders make informed decisions based on the interaction between price and the technical indicator.

- Crossover Opportunity: The signal candlestick presents an opportunity for traders to enter the market after a crossover of the price and the 20 EMA. This crossover signals a potential change in trend direction.

- Entry Point: By focusing on the signal candlestick, traders can accurately identify the entry point for their trades. This allows them to set their buy or sell orders based on the high or low of the candlestick, increasing the chances of a successful trade.

Setting Up Buy Orders

To set up your buy orders, identify the high of the signal candlestick and place your buy stop pending order 1-2 pips above it. This is a crucial step in the EMA Bounce Forex Trading Strategy as it ensures that you enter the market at the right moment. By placing your buy stop pending order above the high of the signal candlestick, you are ready to enter the trade once the price surpasses that level.

This strategy allows you to capitalize on the momentum of the market and see gains almost immediately. To illustrate this further, here is a table showcasing the process of setting up buy orders in the EMA Bounce Forex Trading Strategy:

| Step | Action |

|---|---|

| 1 | Identify the high of the signal candlestick |

| 2 | Place your buy stop pending order 1-2 pips above the high |

| 3 | Wait for the price to surpass the high to trigger your order |

Setting Up Sell Orders

If you want to set up sell orders in this strategy, identify the low of the signal candlestick and place your sell stop pending order 1-2 pips below it. This is the sell trade setup for the 20 EMA Bounce Forex Trading Strategy.

In this strategy, the average crossover entry is used to determine the selling opportunity. When the market price crosses below the 20 exponential moving average (EMA), it signals a downside crossover and indicates a potential selling opportunity.

Once the signal candlestick forms and touches the 20 EMA, you can place your sell stop pending order below its low. It is important to wait for confirmation by observing the next candlestick formation. If the pending order is not activated by the next candlestick, it is advisable to cancel the order.

Effective Stop Loss Placement

Place your stop loss a few pips below the low of the signal candlestick for a buy trade and above the high of the signal candlestick for a sell trade in order to effectively manage your risk. When implementing the 20 EMA Bounce Forex Trading Strategy, it is crucial to have an effective stop loss placement.

Here are three reasons why:

- Risk Management: Placing your stop loss at the appropriate level helps you limit potential losses and protect your trading capital. By placing it below the low of the signal candlestick for a buy trade or above the high of the signal candlestick for a sell trade, you ensure that you exit the trade if the price moves against you.

- Trade Confirmation: The placement of the stop loss aligns with the strategy’s concept of waiting for the retest of the 20 EMA. By placing the stop loss beyond the signal candlestick, you confirm that the price has reversed and is continuing in the desired direction.

- Technical Analysis: The stop loss placement is based on technical analysis principles. It considers the support and resistance levels created by the signal candlestick, providing a logical and objective placement for risk management.

Avoiding Risky Setups

To minimize risk, it is important to avoid taking trades on setups that do not meet the criteria of the 20 EMA Bounce Trading System. Forex traders who follow this strategy understand the importance of risk management techniques and ensuring that their trades align with the trend direction.

The 20 EMA Bounce Forex Trading Strategy relies on the 20 exponential moving average as a key indicator. Traders should only enter trades when the price is closing above or below the 20 EMA, indicating an uptrend or downtrend, respectively. The signal candlestick, which is the first candlestick to touch the 20 EMA after price has moved away from it, is crucial for trade entries.

Determining Profit Targets

When determining profit targets in the 20 EMA Bounce system, traders have a few options to consider. Here are some suggestions to help you determine your profit targets:

- Use previous swing highs as profit targets for buy trades.

- Use previous swing lows as profit targets for sell trades.

- Set your profit target at 3 times the initial risk you took.

- Consider using specific price action candlestick patterns to help you identify potential reversal points during the 20 EMA retests.

By incorporating these profit target options into your trading strategy, you will be exiting your trades according to a plan, not hope.

Always analyze the market conditions and adjust your profit targets accordingly. If a currency pair turns into a choppy range, it may be best to exit your position.

Frequently Asked Questions

How do I identify market trends using the 20 EMA Bounce Forex Trading Strategy?

To identify market trends using the 20 EMA Bounce Forex Trading Strategy, you need to observe the price in relation to the 20 exponential moving average (EMA). If prices are consistently closing above the 20 EMA, it indicates an uptrend. If prices are closing below the 20 EMA, it suggests a downtrend.

What is the importance of the signal candlestick in this trading strategy?

The signal candlestick is an important component of the 20 EMA Bounce Forex Trading Strategy. It is the candlestick that first touches the 20 EMA line after price has been moving away from it.

In an uptrend, the signal candlestick indicates a potential buying opportunity, while in a downtrend, it signals a potential selling opportunity. Traders use the high and low of the signal candlestick to place pending orders and set stop loss levels.

How do I set up buy orders using the 20 EMA Bounce Forex Trading Strategy?

To set up buy orders using the 20 EMA Bounce Forex Trading Strategy, you need to follow these steps:

- Wait for the price to close above the 20 exponential moving average (EMA), indicating an uptrend situation.

- Look for the candlestick that touches the 20 EMA first, known as the signal candlestick.

- Place a buy stop pending order 1-2 pips above the high of the signal candlestick.

- If the order is not activated by the next candlestick, cancel it.

- Set your stop loss a few pips below the low of the signal candlestick.

- Determine your take profit targets using previous swing highs or a risk-reward ratio.

How do I set up sell orders using the 20 EMA Bounce Forex Trading Strategy?

To set up sell orders using the 20 EMA Bounce Forex Trading Strategy, follow these steps:

- Identify a downtrend situation where prices are closing below the 20 EMA.

- The candlestick that touches the 20 EMA first is the signal candlestick.

- Place a pending sell stop order 1-2 pips below the low of the signal candlestick.

- If the order is not activated by the next candlestick, cancel it.

- Set your stop loss a few pips above the high of the signal candlestick.

- Use previous swing lows as profit targets or set a profit target at 3 times your initial risk.

What are some effective methods for placing stop loss orders in this trading strategy?

You can place your stop loss a few pips below the low of the signal candlestick for a buy trade, and above the high of the signal candlestick for a sell trade.

You can adjust the number of pips based on the timeframe you are using as a daily chart may have a tighter stop to the candlestick than a 5 minute chart would.

Another option is to set your stop loss at a level that represents a certain percentage of your initial risk.

Conclusion

The 20 EMA Bounce Forex Trading Strategy is a simple effective system that utilizes the 20 EMA line as a bounce line for candlesticks. By waiting for the retest to happen and watching for the signal candlestick, traders can identify potential buying or selling setups.

The strategy suggests placing stop loss orders a few pips below the low of the signal candlestick for a buy trade, and above the high of the signal candlestick for a sell trade. Profit targets can be set at previous swing highs or lows, or at 3 times the initial risk.

Trading during the London and New York Trading Session when there is higher volatility is recommended. Overall, this strategy provides traders with clear criteria for entering and exiting trades in the forex market.