So you enjoy the free Forex trading signals that I put together every week but have a question about stop loss placement.

Let me say that if that is your first question about these signals, give yourself a pat on the back.

Without defining your risk and getting out of losing trades at your predetermined stop loss point, you will fail at trading.

Placing a stop loss order is the most vital thing you can do to give yourself a chance at a trading career.

Since all the Forex signals are based on price action trading setups and chart patterns, let’s cover using what you can see on the chart as a basis for your stop loss order.

You are going to learn two places you can place your stop loss order using simply structure and your trade entry point:

- behind the signal candle

- behind the nearest swing high/low

What Is A Stop Loss Order

You should know this already but a stop loss order is where you will exit your trade if the trade does not go in your favor. The important key is that whatever your stop loss is, you want to position size in relation to a set % of your account.

Let’s say you risk 1% on every trade and your trading account is $5000.

The calculation is 1% X 5000 = $50.00

This means that for the next trade, your stop loss if hit should not cost you more than $50.00.

When trading Forex, it is easy to use a position size close to smaller amounts due to the different “lot” sizes that exist.

Also keep in mind that when you place a stop loss order, it is a resting order above or below the market. If you short the market, your exit would be a stop loss order at a higher price.

Here is where it can get tricky!

If your stop loss order is hit, the order actually changes to a market order which will be filled at the “best possible price”. That means you may end up losing more than your original risk due to slippage which can occur when using a market order for entries and exits as well.

Bottom line…..know where you will place your stop loss order before entering the trade and never move it further away when price is coming towards it.

Defining The Signal Candlestick

The signal candlestick is the reversal candlestick that you see first and then you place your pending buy stop or sell stop order depending on whether the signal is bullish or bearish signal/trade setup.

- The signal candlestick is NOT the candlestick that activates your pending stop order. That would be the job of the candlestick that forms AFTER the signal candlestick.

- The signal candlestick would be any of these 10 reversal candlestick patterns.

#1: Behind The Signal Candlestick

Let’s use a sell trend line setup is happening and a bearish Harami reversal candlestick pattern forms, then this is what you do:

What if a buy trend line trading setup happens?

Do the exact opposite, like this:

If the signal candlestick is a SINGLE candlestick pattern, you have to use the high/low to do what I just showed you in the two charts above.

#2: Placing Stop Loss Behind Nearest Swing Highs/Lows

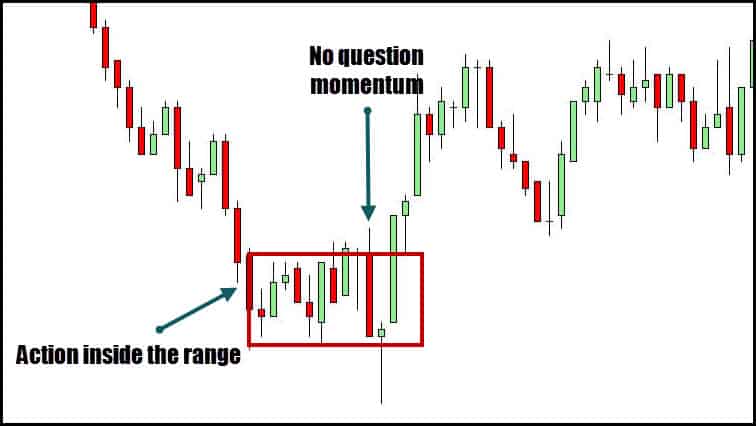

This is where you would use the market structure of a chart. I would use this options when:

- I think that price is very close to my entry price which means if I placed my stop loss behind the signal candlestick high/low, I may get stopped out prematurely.

- the spread of a currency pair is too large and placing behind the signal candlestick high/low would also get me stopped out prematurely.

Now, here’s an important point: if the swing high/low point is too far away, it is going to reduce my risk:reward and this is based on where I’m thinking to place my profit target within the time frame I’m trading.

Lets look at this chart below and assume that:

- EURUSD has a spread of 4 pips

- If your pending buy stop order is activated, your stop loss is going to be very close to the market price which means a little move down and you risk being stopped out.

What would you do? Answer: Look for the nearest swing low.

But…swing low is too far so what do you do?

If The Swing High Swing Low Is Too Far Away

Here’s what I do if I find that the swing high/low is too far away:

I just go back to #1 and increase my stop loss distance to a reasonable distance away to avoid having my stop loss near the market price as well as to avoid getting stopped out by the large spreads of some currency pairs.

Stop Loss For Horizontal Support And Resistance Levels

If you take a trade on a horizontal support or resistance level, placing stop loss is really simple (according to common trading advice): just place it a few pips outside of the support/resistance level/zone.

Again, you must also consider the:

- spread of the currency pair you are trading

- and how far your stop loss will be if your order is activated. If it is too close, move it a bit further away.

I don’t agree with the common way of placing your stop loss orders above or below these areas.

Above and below these levels is always an accumulation of orders either to enter markets or exit the market. They are magnets to price.

Do not simply blindly place your stop loss around these levels. They will be hit and price will probably head in your intended direction.

Keep your stop further from the mass of order sitting in those locations. There is a setup that you can use to take advantage of traders who blindly follow these “trading rules”. It’s called a failure test setup and these trades when they work can send your trades into profit very quickly.

Using Technical Indicators For Stop Loss Placement

Another method you can use to place your stop-loss order for the price action trading signals is to use the technical indicator called the ATR – Average True Range.

Markets have an average move they make on a daily basis (any time frame but I am focusing on the daily) and placing your stop inside this average price range puts your trade in danger.

So how do you calculate the average true range? Use the average true range indicator that is found on most charting platforms

Here we have a bear flag coming after a large momentum move down. The break of the bear flag is confirmed by the large red candlestick and we short the break of lows.

On the day of entry, we measure the ATR of the AUDUSD which in this case is 77 pips. I take 2 X ATR and set my stop loss 154 pips above my entry.

Simple. Objective. Use the volatility of the market.

Some will argue about risk:reward but remember that your reward is never guaranteed. Neither is your stop but you certainly have greater influence over your stop then you did your profit levels.

For that that are curious, this was a 1:1.45 RR and 229 pips of profit from entry to lows.

Thanks for reading my stop loss article!

Please sign up for my FREE Forex Trading Signals that I send out every week.

You can also download this Indicator Blueprint for free that teaches you “special ways” to use common trading indicators.