The daily high low Forex trading strategy is a simple trading technique based on a simple concept: if price breaks yesterday’s high or low, it will most likely continue in that direction of breakout.

That is the common belief but the truth is, it depends.

If you are trading a breakout of a candlestick that is larger than many that came before it, you may actually be taking a trade but get caught in the mean reverting tendency of the market.

This is a basic breakout strategy and I’ve seen a few variations of it throughout the years. It all boils down to one thing:

“An object in motion tends to stay in motion until acted upon by an unbalanced force.”

You can’t argue with the first law of motion but the second part is vital: an unbalanced force.

If you are entering a trade after an out sized momentum move in price, an unbalanced force of buyers or sellers (depending on the position) will either take profits or contrarian trade, and force the market to revert.

With that disclosure, do you think there is an edge in this type of trading? You should do your testing but it is possible there is a slight edge – very slight – it buying a high or selling a low depending on how far advanced the trend is.

Understanding The Basics Of Daily High Low Forex Trading

The strategy involves analyzing the daily high and low prices of currency pairs, and using this information to place trades that take advantage of potential price movements on the next trading day.

Traders who use this strategy typically look for currency pairs that have a clear daily trend, with consistent swing highs and swing lows over several days or weeks. This shows the currency pair is in a trend.

You can also use moving averages to determine the trend on the time frames you choose.

Identifying Daily Highs And Lows

Identifying Daily Highs and Lows is a simple but crucial aspect of the daily high low forex trading strategy. Traders can use these levels to identify the potential entry method area where the market may reverse or continue its trend.

In order to identify daily highs and lows, traders should first look at the previous day’s price action.

A daily high is the highest price that a currency pair reached during a trading day, while a daily low is the lowest price that it reached.

Finding these areas on the daily chart is quite simple – just look at the candlesticks. You want to see clear trending candlesticks and not those in a trading range.

When you accurately identify daily highs and lows on the price chart, you are better equipped to make trading decisions based on a strategy.

Day Trading Strategies

So how do you trade this?

There are two basic strategies: With the trend and either direction.

Both of the can be traded with any currency pair and on any time frame – although four hour charts and above are the most popular approaches. I prefer the daily because I can generally get a larger target than I would on a 5 minute chart. My reward to risk ratios are usually at least 2:1.

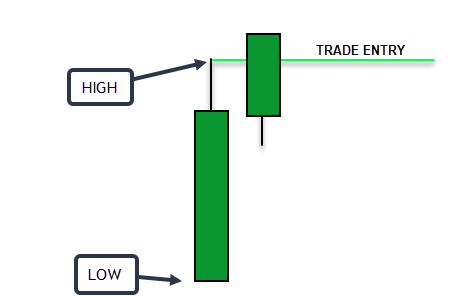

Entry Criteria: Breakout entry above or below the previous periods candlestick.

Entry Price: 2-5 pips above or below the high or low of the previous price range.

Stop Loss: 2-5 pips on the opposite of the entry high/low

Profit Target: Trailing stop loss/price structure/2-3X ATR

Indicators: None required

Trading Skills: Ability to read a chart (Technical analysis)

Setup And Trade Examples

This is the EURUSD and as with any chart, there will be entries all over the place. We need to see a chart that is in a clear uptrend for buys.

The 20 period simple moving average is sloping up and price has taken out a resistance zone. This is bullish.

We look to the closing candle of yesterday and ask “Did it close near the top 1/3 of the session range?”

If it did, we have a potential setup.

The answer is yes.

Next question: “Are we in a trading range?”

The answer here is no.

Trade Breakdown

Entry price: 1.07886 (Above high of yesterday)

Stop loss 1.07038 (Your risk tolerance may be different)

Price structure target: 1.10017 (Previous resistance zone)

2:1 Reward Risk target: 1.09582 ( 2 X range of setup candlestick)

For traders using the ATR indicator, you can simply set your profit target at 1, 2, 3 times the average true range. For this example, 94 pips is the ATR as of the setup candle session.

Advanced Method

One way to take advantage of market volatility and have a higher probability trade is to use other time frames with the daily.

This is a 15 minute chart setup of the same point in time as the previous daily chart.

- Traders can monitor the breakout , wait for a pullback and then place their entry order above the new swing high. Stop would be placed as the original strategy

- This area is more of a key level (the first was more a trading range), and traders may wait for the obvious swing as seen here.

- After the daily volatility rips price higher, traders may wish to move their stop under the most recent swing low to take some risk out of the trade

PRO TIP: When momentum steps in as we seen here, traders may want to take partial profits or exit their trade at the first sign of decreasing momentum. At the very least, do not take a loss on these types of trades.

You can use the same profit targets as the original method or actively manage your trade.

Make sure that the Forex pair you are trading is actually in a trending environment or is showing some type of directional bias.

Daily High Low Trading Strategy Advantages

- Easy to understand: This strategy is relatively simple and easy to understand, making it a good option for beginner traders.

- Based on a clear trend: The strategy is based on identifying the daily high and low points and trading in the direction of the trend, which can provide a clear direction for traders to follow.

- Applicable to different time frames: This strategy can be applied to different time frames, from daily charts to shorter time frames like the hourly or 15-minute charts.

What Are The Disadvantages

- False breakouts: One of the main risks of this strategy is the possibility of false breakouts, where the price breaks through the daily high or low point, but then quickly reverses and moves in the opposite direction.

- Limited trading opportunities: Since this strategy relies on trading in the direction of the daily trend, there may be fewer trading opportunities if the trend is not clear or if the market is consolidating.

- Limited profit potential: This strategy may not be suitable for traders who are looking for high-profit potential, as the take profit target is usually set at a relatively conservative level.

Every trading strategy has its own advantages and disadvantages, and it is up to the trader to determine if the strategy meets their trading goals and risk tolerance.

Traders should always use proper risk management techniques and be aware of the potential risks associated with any trading strategy.