If you’re looking to improve your Forex trading strategy, consider the potential benefits of using the 200 EMA trading strategy approach. This method, based on the analysis of trends and entry points, has gained popularity among traders for its reliability in certain market conditions.

FREE GUIDE: A New Breakout Trading Strategy!

Rules of Simple 200 EMA Strategy

Utilizing the 200 EMA trading strategy involves sticking to specific rules that dictate when to enter long or short positions based on the relationship between price movements and the 200 EMA indicator.

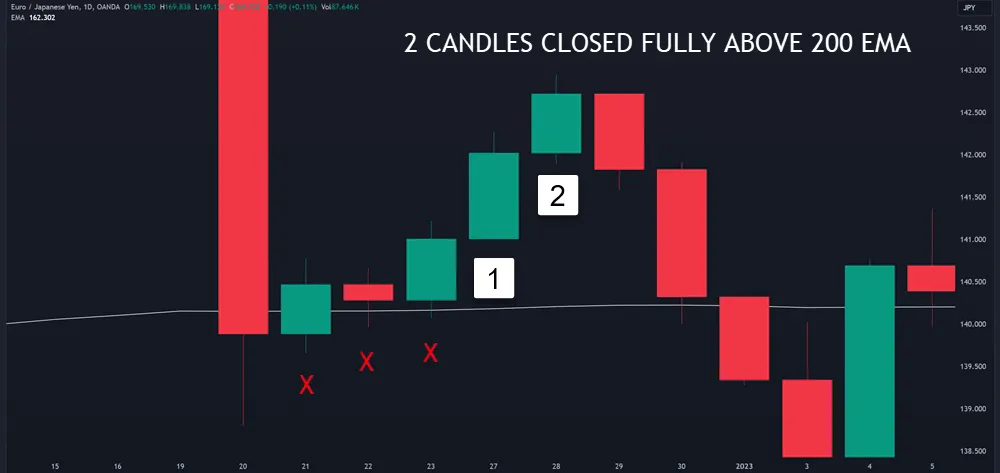

Entry signals for this strategy often involve looking for 2 decisive candles closing above or below the 200 EMA, accompanied by confirmation from other indicators like MACD. After the second candle closes, place a buy/sell stop 5 pips above or below that candle for the entry adjusting around support/resistance zones.

To manage risks effectively, traders should set stop losses just beyond recent swing highs or lows, ensuring protection in case of adverse price movements.

Trend confirmation is vital for the 200 EMA strategy. Traders are advised to confirm the trend across multiple timeframes such as daily, 4-hour, and 1-hour charts before entering a position.

Position sizing is another aspect, with a suggested risk-reward ratio of at least 1:2 to maintain a favorable balance between potential profits and losses.

Backtesting the strategy on historical data can also help in understanding its effectiveness under various market conditions.

Basic 200 EMA Trading Strategy:

The simple strategy can jump on newly forming trends but will run into trouble during consolidation periods. Adding in the support and resistance requirement will cut down on the number of failed trades.

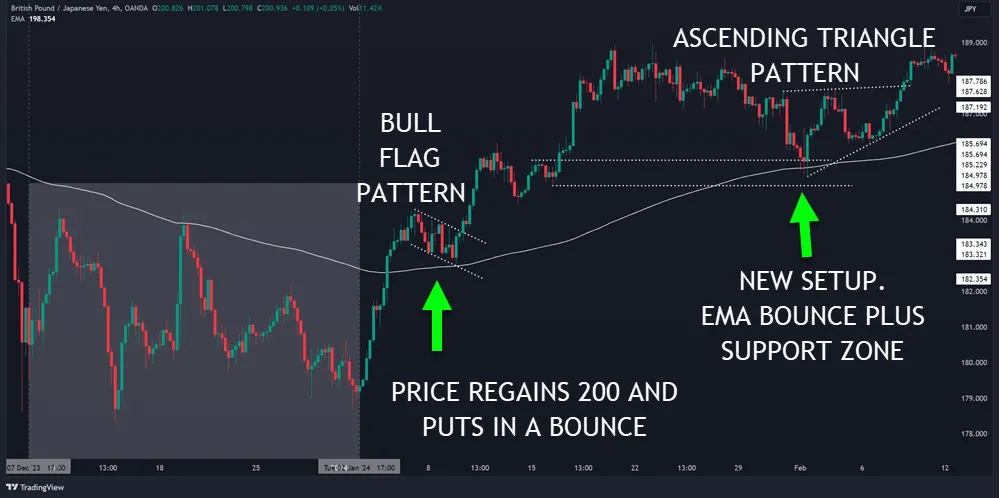

The following approach can use lower time frames as well as chart patterns to help get you into trades.

- Identify the overall trend using the 200 EMA on the daily chart.

- If the price is above the 200 EMA, only look for long trades

- If the price is below the 200 EMA, only look for short trades

- Drop down to the 4-hour chart and look for the price to bounce off the 200 EMA in the direction of the daily trend.

- In an uptrend, look to enter long when the price pulls back to the 200 EMA and forms a bullish reversal candlestick pattern

- In a downtrend, look to enter short when the price rallies up to the 200 EMA and forms a bearish reversal candlestick pattern

- Place your stop loss just beyond the swing high/low that formed at the 200 EMA. Target a reward: risk of at least 2:1.

- For added confirmation, drop down to the 1-hour chart and look for the same setup – price bouncing off the 200 EMA in line with the higher timeframe trend.

- Use the 200 EMA as a trailing stop, moving it to each new swing high/low once the price has moved a significant distance in your favor. Exit the trade if the price closes back beyond the 200 EMA against your position.

The core concepts are:

- Use the 200 EMA to define the overall trend direction on higher timeframes

- Look to enter only in the direction of that trend when the price retraces to the 200 EMA

- Set stops beyond nearby swing points and look for high reward: risk opportunities

- Trail the 200 EMA once in profit to ride the trend

Best Timeframes for 200 EMA Trading

The 200 EMA strategy shows excellent performance on higher timeframes such as the 4-hour and daily charts. When conducting daily chart analysis, the 200 EMA serves as a good tool for trend identification. It’s particularly useful for determining the long-term trend direction.

Traders should focus on taking long trades when the price is above the 200 EMA and short trades when it’s below.

Moving down to the 4-hour chart after establishing the daily trend, traders can then look for entry signals. The 200 EMA in this timeframe can act as dynamic support in an uptrend or resistance in a downtrend. Traders often observe price bounces off the 200 EMA as potential entry points.

While some traders may use the 1-hour chart for faster entries, the 200 EMA’s effectiveness is not very good on lower timeframes due to increased short-term noise.

For a comprehensive approach, combining the daily, 4-hour, and 1-hour charts can be beneficial when using a 200 EMA strategy for swing trading.

200 EMA and 50 EMA Crossover

The 200 EMA crossover approach is a trading strategy that uses the crossover of a shorter-term moving average, typically the 50 EMA, with the longer-term 200 EMA to generate trade signals. Here are the key components of this strategy:

- Identify the overall trend using the 200 EMA on the daily chart

- Price above 200 EMA indicates an uptrend, look for long opportunities

- Price below 200 EMA indicates a downtrend, look for short opportunities

- Drop down to a lower timeframe chart like 4-hour or 1-hour

- Plot the 50 EMA and 200 EMA on this chart

- Look for 50 EMA crossovers of the 200 EMA

- A bullish crossover occurs when the 50 EMA crosses above the 200 EMA

- A bearish crossover occurs when the 50 EMA crosses below the 200 EMA

- Enter a long trade when the 50 EMA crosses above the 200 EMA

- Set a stop loss below the recent swing low or below the 200 EMA

- Take profit at the nearest resistance level or when the 50 EMA crosses back below the 200 EMA

- Enter a short trade when the 50 EMA crosses below the 200 EMA

- Set a stop loss above the recent swing high or above the 200 EMA

- Take profit at the nearest support level or when the 50 EMA crosses back above the 200 EMA

Some additional guidelines:

- Confirm the crossover signal with other tools like MACD, RSI, candlestick patterns, etc.

- Look for the crossover to occur in the direction of the overall trend based on the 200 EMA

- Adjust stop loss to breakeven once the trade moves in your favor by a certain amount

- Trail your stop loss below/above the 50 EMA as the trade progresses to lock in profits

When it comes to position sizing, using such a large distance stop will limit the size of the position you take. This will cut down on profit in a successful trade.

Disclosure: I am not a fan of this style of trading or using large period moving averages for trading.

Reliability of 200 EMA Crossover Approach

Is the reliability of a 200 EMA crossover strategy affected by market conditions and timing?

The effectiveness of a 200 EMA crossover strategy heavily relies on the prevailing market conditions. In strongly trending markets, the strategy can be reliable for trend identification, but it does not do as well during choppy or ranging conditions, leading to frequent false signals and losses.

A 200 EMA crossover strategy is considered a lagging indicator, often missing significant market moves due to its delayed signals.

To improve reliability, combining the 200 EMA with complementary indicators like candlestick patterns or MACD can be a good idea, but strict risk management is essential regardless of your approach.

While the 200 EMA strategy has its merits in trending markets, it’s generally viewed as unreliable when used in isolation, so adding inadditional tools and risk controls is a good idea.

| Pros | Cons |

|---|---|

| Effective in trends | Generates false signals in choppy markets |

| Can aid trend analysis | Lagging nature leads to missed opportunities |

| Potential for profits | Dependency on other indicators for confirmation and risk management is necessary |

Traders can adjust the faster moving average – 50 EMA – to a faster setting such as the 20 or 10 EMA. The shorter the period, the more crosses will occur and the greater chance of whipsaw price action. A knowledge of price action for any strategy is always a good tool to have.

Indicators that Complement the 200 EMA

Combining the 200 EMA with indicators like MACD, Supertrend, Stochastic Oscillator, Pivot Points, and Candlestick Patterns can improve trade entry precision and confirm trend direction effectively.

The Relative Strength Index (RSI) Confirmation can be a valuable addition when using the 200 EMA. It helps validate potential entry points by confirming overbought or oversold conditions in conjunction with the EMA’s trend analysis.

Bollinger Bands is another powerful tool when combined with the 200 EMA. The bands can provide additional insights into price volatility and potential reversal points, aligning with the EMA’s indication of trend direction.

Adding the Fibonacci Retracement level with the 200 EMA strategy can optimize trade setups by identifying key support and resistance levels based on the EMA’s trend direction.

Limitations of 200 EMA Trading Strategies

When using a 200 EMA strategy, you need to acknowledge its limitations. The 200 EMA strategy presents several challenges that traders need to be aware of:

- False signals, risk management: The strategy generates many false signals in ranging markets, leading to potential losing trades. Proper risk management is pivotal to mitigate the impact of these false signals.

- Lagging indicator, wider stop losses: Being a lagging indicator, the 200 EMA provides delayed signals, causing traders to miss out on a significant portion of the trend. This often necessitates wider stop losses to accommodate the delayed nature of the signals.

- Outdated data, standalone approach: Relying solely on the 200 EMA strategy isn’t recommended as it lacks reliability in non-trending markets. It’s crucial to combine this strategy with other tools to improve signal accuracy.

Understanding these limitations can help traders navigate the challenges associated with the 200 EMA strategy and improve their overall trading performance.

Conclusion

The 200 EMA strategy provides a reliable approach to identifying trends and potential entry points in the market. By following the basic rules, utilizing the right timeframes, and combining them with other indicators, traders can boost the effectiveness of this strategy.

Be mindful of its limitations in choppy market conditions and always use proper risk management techniques to maximize success.