You’re about to execute a trade, but have you considered how you’ll protect your profits? Setting effective take-profit orders is essential in forex trading, allowing you to capitalize on successful trades and minimize losses.

By establishing predefined exit points based on historical analysis and market conditions, you’ll avoid emotional decision-making and guarantee a more disciplined approach.

But how do you determine the best take-profit level? What strategies can you use to adapt to changing market conditions? Answering these questions will be key to maximizing your trading potential.

Our 50 EMA Trading Strategy Is POPULAR! Download your free copy here

Main Points

- Understanding take profit orders is important in Forex trading to lock in profits and maintain a favorable reward-to-risk ratio.

- Setting realistic take-profit levels requires evaluating market conditions, support/resistance levels, and historical price action.

- Multiple take-profit levels can capture different profit-taking opportunities and diversify risk across market scenarios.

- Effective trading plan development involves defining elements for guiding profit decisions and incorporating predetermined profit target methods.

- Regular backtesting and analysis of historical data are essential for refining profit execution and continuous improvement in trade performance.

Understanding Take-Profit Orders

To master take profit orders, you must first understand how they work, as these orders instruct your broker to close a trade automatically when the currency price reaches a predetermined level that you’ve set to secure profits.

Fundamentally, take-profit orders help you lock in profits by exiting a trade at a specific price, ensuring a favorable reward-to-risk (r:r) ratio in your trading strategies. By placing take-profit orders, you’re managing your risk and making sure that your profits are secured, rather than leaving them to chance.

When placing take-profit orders, you’ll need to evaluate market conditions, support and resistance levels, and potential upcoming economic news that could impact price movements. Using multiple take-profit levels can also help you capitalize on different profit-taking opportunities as the market trends.

By setting clear exit points, you’re reducing the likelihood of making emotional trading decisions based on fear or greed. By understanding how take-profit orders work, you can create a more disciplined and effective trading strategy.

Key Factors for Profit Targets

When setting profit targets, you must consider several key factors that significantly impact the effectiveness of your take-profit orders.

First, you need to align your profit targets with your risk tolerance to guarantee that your potential rewards justify the level of risk you’re willing to take.

Market conditions, such as volatility and trend strength, also play an essential role in determining effective take-profit settings. You need to adjust your settings based on the current trading environment.

Key support and resistance levels should be considered when placing take-profit orders, as these areas can act as barriers to price movement.

Be aware of upcoming economic news events, as they can cause rapid price fluctuations that may impact your profit targets.

Historical price action analysis can help you identify potential future price movements, allowing you to set informed and realistic take-profit levels.

Strategies for Profit Realization

By using various strategies for profit targets, you can optimize your take-profit orders to effectively capture gains in different market conditions, ultimately improving your overall trading performance. This involves setting up structured approaches to adapt to changing market dynamics.

Here are some key strategies you can implement:

- Fixed Take Profit Levels: Set exact profit targets before entering a trade to guarantee a structured approach to profit realization.

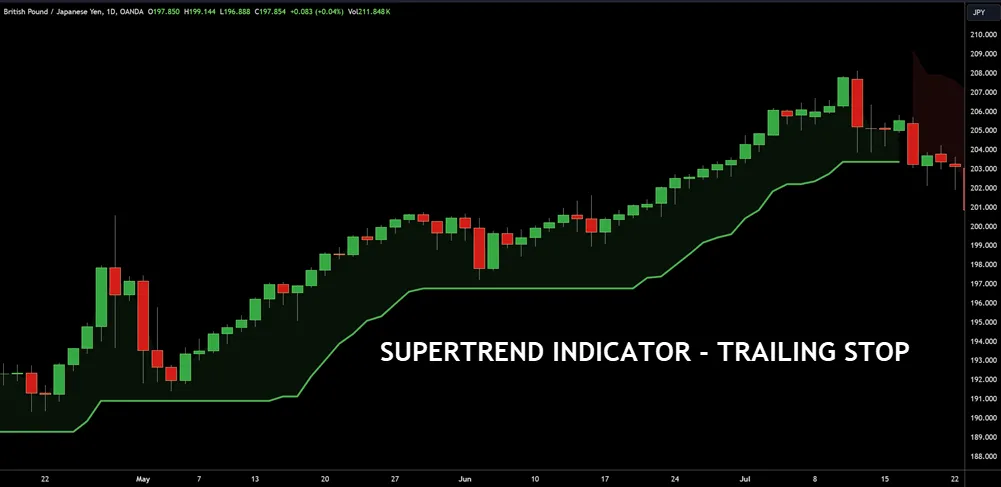

- Trailing Stop Losses: Use trailing stop losses to dynamically adjust your exit point as the market moves in your favor, locking in gains without constant chart monitoring.

- Multiple Take Profit Levels: Implement multiple take profit levels to diversify profit-taking opportunities across varying market conditions, capturing gains at different intervals.

- Spread-Aware Targeting: Consider the impact of the spread when placing take-profit orders and adjust target levels to accommodate transaction costs and market fluctuations.

Regular backtesting and analysis of trading strategies using take-profit orders can improve overall effectiveness by refining timing and levels for profit-taking based on historical data.

Effective Trading Plan Development

As you develop your trading plan, you’ll need to define key elements that guide your take profit decisions, including the structuring of profit targets that align with your risk tolerance and overall strategy.

By doing so, you’ll establish a disciplined approach to taking your profits, helping you avoid impulsive decisions driven by emotions rather than market analysis.

You’ll also want to guarantee that your plan incorporates mechanisms for adapting to changing market conditions, allowing you to refine your take-profit strategies over time.

Key Trading Plan Elements

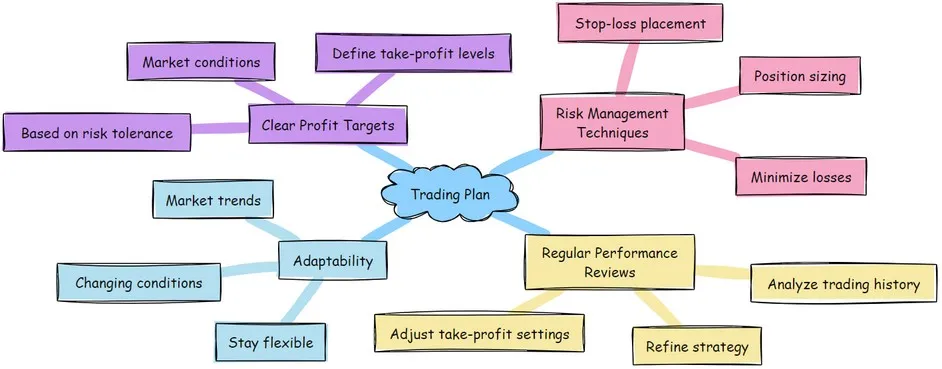

Developing an effective trading plan requires that you define key elements, including clear profit targets and risk management strategies, to guarantee consistency and discipline in your trading decisions.

A well-structured plan helps you navigate the markets with confidence, ensuring you don’t let emotions dictate your profit-taking decisions. By establishing predetermined profit targets, you maintain consistency across trades and maximize profit realization.

Here are four essential elements to include in your trading plan:

- Clear profit targets: Define your take-profit levels based on your risk tolerance and market conditions.

- Risk management techniques: Incorporate stop-loss placement and position sizing to minimize losses.

- Regular performance reviews: Analyze your trading history to refine your strategy and adjust your take-profit settings.

- Adaptability: Stay flexible and adjust your plan according to market trends and changing conditions.

Structuring Profit Targets Effectively

Your trading plan’s effectiveness relies heavily on structuring profit targets that align with your risk tolerance and overall strategy.

To do this, you should analyze historical price action and key support and resistance levels to improve the likelihood of success in reaching those levels. This careful analysis will help you set realistic and achievable profit targets that are tailored to your unique trading approach.

When structuring your profit targets, it’s essential to take into account the reward-to-risk ratio. Aim for a favorable ratio, such as 2:1 or higher, to support sustained profitability.

Utilizing multiple take-profit levels is also a good idea, as it allows you to lock in profits at various points and adjust for market volatility.

Additionally, regular backtesting and adjustment of your profit targets based on market conditions and trading results will help you continually improve your trade performance and strategy effectiveness.

Continuous Improvement in Trading

By refining your take-profit order strategies through effective management, you lay the groundwork for continuous improvement in trading. This involves regular analysis of historical performance data to identify areas for development and optimize profit realization over time.

You’ll want to regularly analyze your past trades to spot patterns and refine your strategies. This helps you boost your profit realization over time.

You also engage in community discussions and feedback sessions to gain valuable insights and alternative methodologies. These help you adapt and evolve your trading practices.

When backtesting, you incorporate duration analysis to assess how long price movements take to reach take profit levels, managing expectations and reducing emotional reactions.

Maintaining a trading diary or log promotes self-reflection, identifying areas for psychological improvement and stronger discipline.

Use educational resources like webinars or articles on trends and risk management to develop your skill set, building a mindset geared toward continuous learning and adaptation. In short, keep learning!

This ongoing process helps you improve your skills, adapt to changing market trends, and ultimately make more educated trading choices.

Frequently Asked Questions

Can Take Profit Orders Be Used in Combination With Stop-Loss Orders?

You can use take-profit orders in combination with stop-loss orders to create a balanced risk management strategy, capturing profits while limiting potential losses, and improving your overall trading performance and discipline.

How Do I Adjust My Take Profit Levels in Volatile Markets?

You’ll adjust your take-profit levels in volatile markets by widening them to accommodate larger price swings, analyzing recent price action to set levels slightly above resistance or below support zones, and regularly monitoring the average true range (ATR).

What Is the Ideal Profit Target for a Beginner Forex Trader?

You’ll typically set an ideal profit target as a beginner Forex trader at a 1:2 or 1:3 reward-to-risk ratio, meaning for every dollar you risk, you aim to earn two or three dollars in profit.

Can I Use Take Profit Orders With Scalping Strategies in Forex?

You can use take profit orders with scalping strategies in Forex, as they help you secure quick profits from small price movements, typically aiming for 5-10 pips per trade, and adjust levels to optimize gains.

Are Take Profit Orders Suitable for All Types of Forex Trading Accounts?

You can use take profit orders with any type of forex trading account, as they help you maintain a disciplined trading strategy and lock in profits at predefined price levels, regardless of account size or type.

Conclusion

By setting effective profit targets and employing strategies like trailing stop losses and multiple profit targets, you’ll be better equipped to handle different and dynamic market environments.

Regular analysis and continuous learning will further improve your trading skills.

With a well-developed trading plan and the ability to manage and take profit orders, you’ll be able to secure profits while mitigating risks in the forex market.