You’ve heard traders boasting about massive gains and risky positions, but there’s a different approach that keeps it simple and has a higher probability of success: the 10 pips a day strategy.

This trading system focuses on consistent, smaller profits rather than volatile home runs, allowing you to build your account steadily while minimizing risk. Whether you’re new to forex trading or looking to refine your current approach, understanding how to implement this strategy can transform your trading career into a much simpler approach.

DOWNLOAD MY FREE 50 EMA TRADING STRATEGY I PUT TOGETHER FOR READERS OF THIS BLOG! DOWNLOAD HERE

TLDR

- Focus on capturing small, consistent 10-pip gains across major currency pairs during peak trading sessions like London-New York overlap.

- Set strict stop-loss orders 5-7 pips from entry point and move to break-even once trade becomes profitable.

- Trade only during active market hours and prioritize liquid pairs like EUR/USD, GBP/USD, USD/JPY, and USD/CAD.

- Limit risk to 1-2% of account balance per trade and use Average True Range for position sizing.

- Document all trades and maintain emotional discipline, focusing on consistency rather than chasing large profits.

Understanding the 10 Pips Strategy

Every successful Forex trader knows that consistency beats occasional big wins. That’s why the 10 pips a day strategy has gained popularity among traders who prefer steady returns over looking for the heavy hitter returns. This approach focuses on making small, achievable gains through careful market analysis and disciplined trading.

The strategy’s core principle is simple: you’ll aim to earn just 10 pips per trade, regardless of the currency pair you’re trading. Before choosing your pairs, you’ll need to consider currency correlation to avoid overlapping risks. A proper trade setup involves identifying key support and resistance levels, then waiting for clear entry signals.

| Aspect | Description |

|---|---|

| Goal | Earn 10 pips per trade consistently |

| Focus | Small, achievable gains |

| Method | Careful market analysis and disciplined trading |

| Currency Pairs | Consider correlation to avoid overlapping risks |

| Trade Setup | Identify key support and resistance levels |

| Entry | Wait for clear entry signals |

| Preparation | Backtest strategy with different pairs and market conditions |

| Profit Target | 10 pips plus spread |

| Risk Management | Use strict stop-losses to protect capital |

| Best Performance | During London and NY sessions (high volatility and volume) |

| Philosophy | Consistent small gains over occasional big wins |

You’ll want to start by backtesting strategy performance with different currency pairs during various market conditions. Set a realistic profit target of 10 pips (plus spread) and stick to it – don’t let greed push you to hold positions longer.

It’s important to use strict stop-losses to protect your capital when trades move against you. Remember, this strategy isn’t about hitting home runs; it’s about consistently hitting singles that add up over time.

The strategy performs best during London and NY sessions when market volatility and trading volume are at their peaks.

Market Selection and Timing

Success with the 10 pips strategy depends on selecting the right markets and trading times. You’ll want to focus on major currency pairs during their most active trading sessions, when price patterns are clearest and market analysis is most reliable. Understanding currency correlation helps you avoid doubling your risk by trading highly correlated pairs simultaneously.

| Trading Session | Best Pairs | Economic Indicators |

|---|---|---|

| London Open | EUR/USD, GBP/USD | UK/EU PMI Data |

| New York Open | USD/JPY, USD/CAD | US Job Reports |

| Asian Open (Not recommended) | AUD/USD, NZD/USD | Chinese GDP |

The most profitable times to trade are usually during session overlaps, when market activity peaks. The London-New York overlap (8:00-12:00 EST) offers excellent opportunities for capturing your 10 pips target.

Watch economic indicators releases during these times, as they can create the perfect conditions for quick pip gains. Start by tracking price movements during different sessions and noting which pairs move most predictably during your chosen trading hours.

Remember, consistency in your market selection and timing is often more important than trying to catch every possible movement. The Asian trading session typically has slower price movements and lower volatility compared to other major sessions.

Entry and Exit Rules

Clear entry and exit rules form the basis of the 10 pips strategy, turning it from a simple concept into a practical trading system.

You’ll need to watch for specific entry criteria, like breakouts from key support or resistance levels, along with confirming signals from momentum indicators.

When you spot a potential trade setup, don’t rush in. Wait for your market signals to align – this might include price action patterns, trend direction, and volume confirmation (FX Futures only). Your trade timing should consider market sessions when your chosen currency pair is most active.

For exit tactics, set your profit targets at 10 pips from your entry point. Place your stop-loss order at a level that protects your capital, typically 5-7 pips away from your entry. Once you’re in profit by a few pips, consider moving your stop-loss to break-even to protect your gains.

Remember to stick to these rules or any rules you are using. These are just examples and I have added a complete strategy below. Don’t be tempted to hold trades longer just because they’re winning, and don’t move your stop-loss wider when trades go against you.

Your success depends on disciplined execution of these entry and exit rules.

The London session typically offers better trading conditions

Risk Management Essentials

Proper risk management lies at the heart of the 10 pips strategy’s long-term sustainability. You’ll need to conduct thorough risk assessment before each trade to protect your capital and ensure consistent profits over time. Start by determining how much of your account you’re willing to risk on each trade – most successful traders stick to 1-2% per position.

Your trade sizing should always align with your risk tolerance, and you’ll want to adjust your position size based on your account balance. Don’t let market psychology push you into overextending your positions.

While borrowing (leverage) can increase your gains, you need to understand its implications and use it conservatively.

Implementing effective stop loss strategies is non-negotiable. Place your stops at levels that protect your capital while giving your trades enough room to breathe. You’ll want to set your stop loss at a distance that keeps your total risk within your predetermined limits.

Consider using the Average True Range indicator to help determine appropriate position sizes based on current market volatility.

Enhanced 10 Pips Per Day Forex Trading Strategy

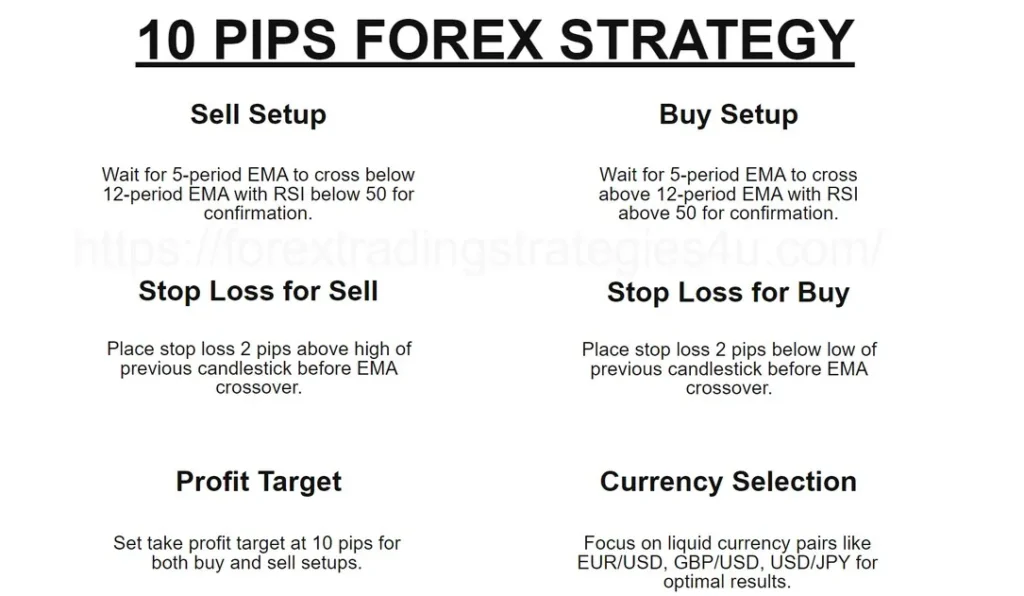

Sell Setup

- Entry Criteria:

- Wait for the 5-period Exponential Moving Average (EMA) to cross below the 12-period EMA on the downside.

- Confirm the entry by checking that the Relative Strength Index (RSI 9) has crossed below the 50 level.

- Sell at break of low candle that turned the averages and confirmed the RSI

- Stop Loss Placement:

- Place the stop loss 2 pips above the high of the previous candlestick that closed before the EMA crossover.

- Take Profit Target:

- Set the take profit target at 10 pips.

Buy Setup

- Entry Criteria:

- Wait for the 5-period EMA to cross above the 12-period EMA on the upside.

- Confirm the entry by checking that the RSI has crossed above the 50 level.

- Buy at break of high candle that turned the averages and confirmed the RSI

- Stop Loss Placement:

- Place the stop loss 2 pips below the low of the previous candlestick that closed before the EMA crossover.

- Take Profit Target:

- Set the take profit target at 10 pips.

General Guidelines

- Currency Pair Selection:

- Focus on highly liquid currency pairs, such as EUR/USD, GBP/USD, and USD/JPY.

- Time Frame:

- Use the 5-minute time frame for executing the trades.

- Use US/London overlap and London Session

- Risk Management:

- Limit the risk per trade to 1-2% of your account balance.

- Implement a daily loss limit (e.g., 20-30 pips) to prevent significant drawdowns.

- Consider using a trailing stop-loss to lock in profits as the trade moves in your favor.

- Look for areas to take profit or manage trade in relation to price action (see first example)

- Monitoring and Adaptation:

- Regularly review your trading performance and adjust the strategy as needed based on market conditions.

- Keep a detailed trading journal to identify areas for improvement.

Psychology of Small Gains

While risk management protects your capital, mastering the mental game of small gains determines whether you’ll stick with the 10 pips strategy.

You’ll need to shift your perspective from seeking the thrill of big trades to appreciating steady progress in your trading account. Understanding that trading is a skill developed through patience and discipline will help maintain realistic expectations.

| Mental Aspect | Challenge | Solution |

|---|---|---|

| Setting expectations | Wanting quick riches | Focus on daily small wins |

| Emotional discipline | Fear of missing out | Stick to your trading plan |

| Patience practice | Overtrading urges | Wait for clear setups |

| Consistency commitment | Changing strategies | Trust the process |

| Mindset mastery | Result attachment | Focus on execution |

Trading Tools and Platforms

Successful implementation of the 10 pips strategy requires three essential trading tools: a reliable broker platform, real-time charting software, and a trade management system.

When choosing your broker platform, look for one that offers tight spreads, fast execution, and reliable customer support. Popular options like MetaTrader 4 or 5 provide comprehensive chart analysis features that’ll help you spot potential trading opportunities.

Your charting software should include essential trading indicators like moving averages, RSI, and MACD to help identify market trends and entry points. Make sure your platform displays real-time price movements and allows you to set precise stop-loss and take-profit levels for your 10-pip targets.

Don’t overlook automation tools that can help streamline your trading process. Features like one-click trading and automated position sizing calculators can save precious seconds when executing trades.

Some platforms also offer customizable alerts to notify you of potential trading setups. Remember, your success with the 10 pips strategy depends heavily on how effectively you use these tools together – they’re not just add-ons but BIG components of your trading system.

Common Pitfalls to Avoid

Trading discipline and awareness can help you avoid major mistakes in your 10 pips strategy.

Being aware of common trading mistakes can save you from unnecessary losses and help maintain consistent profits in the long run.

One of the biggest challenges you’ll face is maintaining emotional discipline. Don’t let fear or greed drive your decisions – stick to your strategy even when the market tests your patience.

Managing expectations is also needed; remember that you won’t hit your 10-pip target every single day, and that’s okay.

Pay attention to strategy adaptation as market conditions change. What works during calm markets mightn’t be effective during volatile periods. You’ll need to adjust your approach while keeping your core principles intact.

Poor market analysis is another common pitfall – don’t rush into trades without proper technical and fundamental analysis.

Watch out for overtrading in an attempt to recover losses. If you miss your daily target, accept it and move on.

Scaling Your Trading Success

Once you’ve mastered the basics of the 10 pips strategy, scaling up your trading becomes the next logical step. To expand your success, you’ll need to maintain strict trading discipline while gradually increasing your position sizes.

Start by documenting every trade and monitoring your performance tracking metrics to identify what’s working best. Your market analysis skills should improve with experience, allowing you to spot more opportunities throughout the trading day.

Don’t rush – focus on profit consistency before increasing your trade frequency or position sizes. When you’re consistently profitable, consider adding another trading session to your day or exploring additional currency pairs.

Make strategy adjustments based on your documented results, not emotions or hunches. If you’re hitting your 10 pips target regularly, you might try for 15 pips on some trades while maintaining your risk management rules.

Remember to scale your position sizes in proportion to your account growth, and never risk more than you can afford to lose. Keep reviewing your progress weekly and monthly to ensure you’re growing steadily and sustainably.

Your Questions Answered

Can the 10 Pips Strategy Be Combined With Other Trading Strategies?

You can effectively combine the 10 pips strategy with other trading approaches to improve your market analysis and improve results.

Focus on strategy diversification while maintaining consistent risk management practices. Keep track of your performance to see which combinations work best.

Trade psychology – don’t let multiple strategies overwhelm your decision-making process or lead to overtrading.

How Long Does It Typically Take to Master the 10 Pips Strategy?

You’ll typically need 3-6 months to master the 10 pips strategy, though learning curves vary by individual.

The key is understanding how to manage the trade since slight movements against you can take you out. Be on alert for ANY change in price action that suggest a move against the position.

Does the Strategy Work Equally Well During Economic News Releases?

You shouldn’t trade the 10 pips strategy during major economic news releases.

News volatility can cause rapid price swings and unpredictable market reactions that make it hard to maintain your usual trading psychology.

Economic indicators often trigger large movements that exceed your typical pip targets and stop-losses.

It’s safer to wait until markets settle down and resume your normal risk management approach.

What Percentage of Traders Successfully Maintain Consistent Profits With This Strategy?

You’ll find that only about 10-15% of traders maintain consistent profits with strict trading discipline and proper risk management.

Market volatility and trader psychology play roles in success rates, as many struggle to stick to their profit targets.

Those who succeed typically focus on maintaining emotional control, following a structured approach, and accepting that not every trade will be profitable.

Is the 10 Pips Strategy More Effective With Certain Trading Session Overlaps?

You’ll find the most success with your trading during the London-New York overlap (8 AM – 12 PM EST), when session dynamics create higher market volatility and better opportunities.

This period offers improved execution speed and more predictable price movements. However, you’ll need strong risk management and solid trader psychology, as the increased activity can be overwhelming.

The Asian-London overlap can also work well but typically shows less consistent movement.